On This Page

If you’re looking to expand your healthcare practice, there are a number of alternative funding options, in addition to the traditional channels.

Alternatives may allow you to tap into community support and gain flexible repayment structures, making them attractive choices.

Other options include seeking angel investors, leveraging grants, REIT funding, strategic partnerships or exploring peer-to-peer lending for quick access to funds.

Tax incentives from government programs can provide additional financial relief.

Key Takeaways

- Explore crowdfunding platforms like GoFundMe and Kickstarter to engage the community and raise funds for specific healthcare projects or initiatives.

- Consider peer-to-peer lending for quick access to capital with flexible repayment terms, directly connecting borrowers with individual lenders.

- Consider the pros and cons of accessing expansion capital through a REIT investment funding

- Utilize revenue-based financing to secure funds while repaying based on future revenues, offering a more adaptable repayment structure than traditional loans.

- Investigate strategic partnerships with other healthcare entities to leverage shared resources and access new markets for practice expansion.

- Look into grants and competitions that provide financial support and networking opportunities, focusing on healthcare innovation and research.

Traditional Funding Methods and Their Limitations

Healthcare practice expansion funding from traditional funding methods like bank loans and personal savings are usually the first and obvious choices.

However, these options come with notable limitations that can impact your growth strategy.

Bank loans typically require a strong credit history and collateral, which developing healthcare practices may not have.

Being less flexible, the burden of bank debt for early-stage expansion can affect your practice’s cash flow and limit your ability to invest in critical resources or technology.

Qualification may also be a lengthy process which can delay your expansion rollout.

Using personal savings is a straightforward route, but has obvious limitations, and can put your financial stability at risk.

Tapping into your savings means diverting funds from your personal needs or retirement plans, which isn’t sustainable in the long run.

Ultimately, while traditional funding methods can provide necessary capital, they come with constraints that can hinder your ability to adapt and grow your healthcare practice efficiently.

Alternative Financing Options

Crowdfunding platforms like GoFundMe or Kickstarter allow you to present your vision and gather small amounts of money from many individuals.

This not only helps you fund your project but also builds a community of supporters.

Another option is peer-to-peer lending, where you can borrow money directly from individuals through online platforms.

This method often has more flexible terms than traditional loans, making it easier for you to secure funds.

You might also consider invoice financing, where you can sell your unpaid invoices to a third party for immediate cash. This can help maintain cash flow and keep your practice running smoothly during expansion.

Lastly, don’t overlook grants. Various organizations offer grants specifically for healthcare innovations, and while they can be competitive, they provide funds that don’t need to be repaid.

REIT funding can serve as a viable alternative funding source for medical practices, enabling monetization of real estate assets while maintaining operational control.

Venture capital and angel investors can provide strategic guidance and industry expertise as a value-add to the capital funding, although the price of this involvement must be carefully considered by business founders.

Venture Capital and Angel Investors

Venture capital and angel investors can be game-changers for healthcare practices looking to expand.

These funding sources provide not only capital but also strategic guidance and industry expertise.

When you seek investment from venture capitalists or angel investors, typically you’re tapping into a network of individuals and firms eager to support promising healthcare innovations.

Angel investors, often wealthy individuals, can offer you early-stage funding and a more personal touch.

They’re typically willing to take on higher risks in exchange for potentially high returns, and their experience can help you navigate the complexities of healthcare.

On the other hand, venture capitalists usually invest larger sums but expect a well-defined growth strategy and significant returns within a fairly short time frame, a few years.

This also requires Founders to be comfortable giving up a level of control, and the associated business risk that entails.

To attract these investors, requires a compelling business plan that outlines your unique value proposition, market potential, and financial projections.

It’s crucial to demonstrate how their investment will drive growth and improve patient outcomes.

Crowdfunding

Crowdfunding has emerged as an innovative financing option for healthcare practices aiming to expand their services.

By leveraging platforms like GoFundMe, Kickstarter, or Indiegogo, you can connect directly with potential patients and supporters who believe in your mission.

This method allows you to raise funds without the need for traditional loans or investors, giving you more control over your practice’s future.

To launch a successful crowdfunding campaign, you’ll need to tell a compelling story.

Clearly articulate your vision, the services you want to expand, and how that benefits the community.

Engaging visuals and videos can help convey your passion and make your campaign more relatable.

Additionally, consider offering incentives for different donation levels, such as free consultations or exclusive health workshops.

Marketing your campaign is crucial. Use social media, email newsletters, and local media coverage to spread the word.

Transparency is key; ongoing support and eventual success depend on keeping backers updated on progress, and how their contributions are making a difference.

Revenue-Based Financing

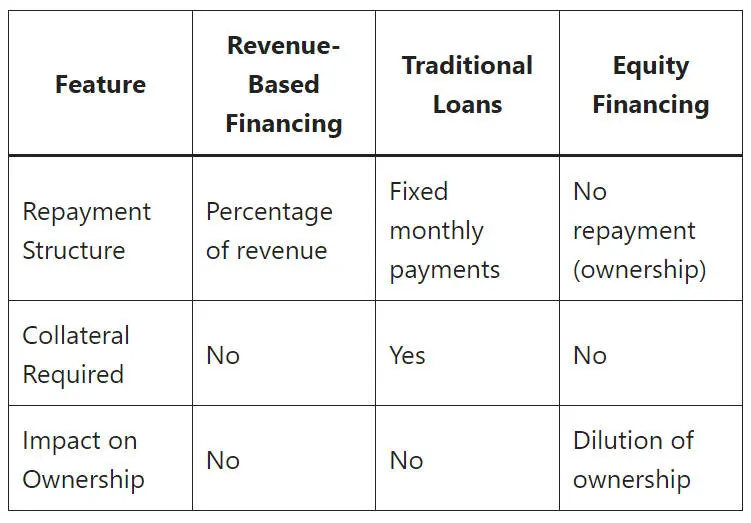

As you explore various funding options for your healthcare practice expansion, revenue-based financing stands out as a flexible alternative.

This approach allows you to raise capital by pledging a percentage of your future revenue, making it particularly appealing if you expect your earnings to grow.

Unlike traditional loans, there’s no fixed repayment schedule or collateral required, which reduces financial strain.

With revenue-based financing, you only repay when your practice generates income, aligning payments with cash flow.

This means you can focus on your growth without the pressure of monthly loan payments. It’s a great way to fuel expansion while keeping your financial commitments manageable.

Here’s a quick comparison of key features:

Healthcare-Specific Loans and Grants

When you’re looking to expand your healthcare practice, healthcare-specific loans and grants can really come into play.

These funding options can be tailored to the unique needs of medical professionals, making them an excellent choice for your expansion plans.

Healthcare-specific loans often offer favorable terms, such as lower interest rates and extended repayment periods, which can ease the financial burden of growth.

You can use these funds for various purposes, including purchasing new equipment, renovating your facility, or hiring additional staff.

Grants, on the other hand, provide a unique opportunity since they don’t require repayment.

Many organizations offer grants aimed specifically at improving healthcare access or developing innovative services.

Researching these grant opportunities can reveal potential funding sources that align with your practice’s mission.

Eligibility criteria, application processes, and available funding can vary, so it’s important to seek the guidance of relevantly experienced financial advisors when navigating what’s on offer.

To maximize your chances of securing these loans or grants, a solid business plan may be an essential or highly advised success factor.

The Plan will outline your expansion goals, anticipated outcomes, and how the funding will benefit your practice and the community.

Below is an indication of possible funding sources:

| Source | Type | Description | Link |

| Small Business Administration (SBA) | Loans | SBA 7(a) loans tailored for healthcare practices | link |

| Health Resources and Services Administration (HRSA) | Grants | Various grants for healthcare services and workforce development | link |

| National Institutes of Health (NIH) | Grants | Research grants for medical and health-related studies | link |

| Centers for Disease Control and Prevention (CDC) | Grants | Grants for public health initiatives and research | link |

| Centers for Medicare & Medicaid Services (CMS) | Grants | Grants for healthcare innovation and improvement | link |

| Funding Circle | Loans | Specialized loans for medical practices | link |

| National Business Capital | Loans | Healthcare practice loans and equipment financing | link |

| Bank of America | Loans | Practice loans for healthcare professionals | link |

| Wells Fargo | Loans | Healthcare practice financing options | link |

| U.S. Department of Agriculture (USDA) | Loans & Grants | Rural development loans and grants for healthcare facilities | link |

Tax Incentives

Eligibility for tax incentives should be the subject of discussion with your financial advisor.

Here are some of the measures which may or may not apply in your circumstances:

Healthcare practices in the USA may be eligible for several tax incentives and credits from government programs. Here are some key tax incentives that could apply:

Employee Retention Tax Credit (ERTC)

The Employee Retention Tax Credit was created to help businesses, including healthcare practices, retain employees during the COVID-19 pandemic.

The ERTC is a payroll tax credit for periods up to December 2020

The ERTC program is nearing its conclusion, but you should review your eligibility if your haven’t already done so.

Research & Development (R&D) Tax Credit

Healthcare and medical practices engaged in developing new or improved products, processes, or software may be eligible for R&D tax credits.

Energy Efficiency Tax Incentives

The Inflation Reduction Act introduced new clean energy tax credits that healthcare facilities can leverage.

Other Potential Credits and Deductions

- Deductions for medical equipment purchases

- Credits for making facilities more accessible under the Americans with Disabilities Act

- Work Opportunity Tax Credit for hiring from certain target groups

Considerations for Tax-Exempt Organizations

Many of these incentives are also available to non-profit healthcare organizations:

- Tax-exempt entities can elect to treat certain credits as direct payments from the IRS, essentially making them refundable.

- This allows non-profits to benefit even if they don’t have tax liability.

State and Local Tax (SALT) Incentives

Healthcare practices operating across multiple states should explore state-specific tax incentives and credits that may be available.

Partnering with Private Equity Firms

Partnering with private equity firms can be a strategic move for healthcare practices looking to expand.

These firms often bring not just capital but also valuable expertise and resources that can help you scale your operations efficiently.

When you align with a private equity partner, you gain access to their extensive network, which can lead to new patient acquisition and operational improvements.

One significant advantage is the ability to leverage their financial backing to undertake large projects, whether it’s opening new locations or enhancing existing facilities.

You’re not just receiving funds; you’re getting a partner invested in your success.

This partnership can also facilitate strategic planning and management, enabling you to focus more on patient care rather than administrative burdens.

However, it’s crucial to choose the right firm that aligns with your practice’s values and goals.

Not all private equity firms operate the same way, so doing your due diligence is essential.

Private equity is typically geared to short-term goals, are highly results focused, and expect a (varying) level of management involvement.

A well-selected partner can help you navigate the complexities of expansion, ensuring that your practice not only grows but thrives in a competitive healthcare environment.

Equipment Leasing and Financing

Expanding your healthcare practice often means investing in new equipment, and equipment leasing and financing can provide a practical solution.

Instead of paying upfront for costly devices, you can lease or finance equipment, allowing you to preserve your capital for other essential areas of your practice.

Leasing gives you access to the latest technology without the burden of ownership.

You can upgrade equipment more frequently, ensuring you always have the best tools for patient care.

With lower monthly payments compared to traditional loans, leasing can help manage your cash flow more effectively.

On the other hand, financing allows you to buy the equipment outright while spreading the cost over time.

This option can be beneficial if you prefer ownership and want to build equity.

Many financing plans also offer flexible terms tailored to your financial situation.

Both leasing and financing can enhance your practice’s operational capabilities without straining your budget.

By carefully assessing your needs and evaluating different offers, you can choose the option that best aligns with your practice’s growth strategy.

Utilizing Real Estate Investment Trusts (REITs)

Consider tapping into Real Estate Investment Trusts (REITs) as a strategic funding option for your healthcare practice expansion.

REITs allow you to invest in real estate without having to buy or manage properties directly.

This can be particularly beneficial for healthcare practices looking to expand their facilities or services.

Here’s a quick overview of the advantages of utilizing REITs:

| Advantages of REITs | Considerations |

|---|---|

| Liquidity: Easily buy/sell shares | Market fluctuations can affect value |

| Diversification: Invest in various properties | Limited control over property management |

| Passive income: Regular dividends | Dividend payouts may vary |

| Professional management: Expert oversight | Fees may reduce overall returns |

| Tax benefits: Potential tax advantages | Regulatory compliance requirements |

How REITs Can Fund Medical Practices

Sale-Leaseback Transactions

One of the primary ways REITs can provide funding for medical practices is through sale-leaseback transactions:

- The medical practice sells its real estate (eg, office building, clinic) to a healthcare REIT.

- The REIT then leases the property back to the medical practice, typically under a long-term triple net lease.

- This arrangement provides the medical practice with a large cash infusion from the sale, which can be used for various purposes such as expanding operations, purchasing equipment, or paying off debt.

Benefits of REITs for Medical Practices

Utilizing REITs as a funding source offers several advantages:

- Capital Unlock : Allows practices to access the tied value up in their real estate without losing the use of the property.

- Focus on Core Operations : Enables healthcare providers to concentrate on patient care rather than property management.

- Improved Balance Sheet : Moving real estate off the balance sheet can enhance debt capacity and potentially improve financial ratios.

- Predictable Expenses : Long-term leases provide stability in occupancy costs.

Types of Properties Involved

Healthcare REITs are interested in various medical real estate assets, including:

Considerations for Medical Practices

While REITs can be an attractive funding option, medical practices should consider the following:

- Loss of Asset Control : Selling to a REIT means giving up control over the property and potential future appreciation.

- Long-Term Commitment : Sale-leaseback agreements often involve extended lease terms, which may limit flexibility.

- Market Dependence : REIT investments are influenced by real estate market conditions.

The healthcare real estate market has been growing, with REITs showing increased interest in medical properties:

- In 2021, REITs held investments in 1,915 (16%) US nursing homes.(source)

- Some REITs are focusing on physician-owned healthcare properties and hospital/physician partnerships. (source)

Strategic Partnerships

Forming strategic partnerships can be a game-changer for your healthcare practice expansion, as they create opportunities for shared resources and expertise.

By collaborating with other healthcare providers, organizations, or even technology firms, you can enhance service offerings, improve patient care, and streamline operations with economies of scale.

This approach can expand your reach and helps to mitigate risks associated with growth.

Consider these benefits of strategic partnerships:

- Access to New Markets: Partnering with established organizations allows you to tap into their patient base and geographical reach.

- Resource Sharing: Pooling resources can lead to cost savings, whether it’s sharing staff, technology, or facilities.

- Enhanced Innovation: Collaborating with technology firms or research institutions can introduce cutting-edge solutions to your practice.

Peer-to-Peer Lending

Many healthcare practitioners are turning to peer-to-peer lending as a viable funding option for practice expansion.

This approach connects you directly with individual investors, allowing you to secure loans without going through traditional banks.

With lower interest rates and flexible terms, peer-to-peer lending can be an attractive alternative.

Here are some benefits to consider:

- Speedy Funding: You can often receive funds faster than through conventional lending routes.

- Personalized Terms: You have the flexibility to negotiate terms that suit your practice’s cash flow and repayment capabilities.

- Community Support: Investors are often motivated by a desire to support local healthcare initiatives, fostering a sense of community.